- Track Complaint

- A+

- A-

Business in India cannot be imagined withoutbeing registered in GST. Be it a small retailer, service provider, or e-commerce player, a knowledge of GST registration will help you stay compliant and continue to do business legally. GST was introduced in order to bring various indirect taxes under one roof to make taxation easier and more transparent.

Under the Goods and Services Tax regime, registration is the process by which a business or an individual registers itself under the Goods and Services Tax Act. Post successful registration, a unique 15-digit Identification Number is generated called Goods and Services Tax Identification Number (GSTIN), which is the legal identity of the registered business.

A registered business can:

GST registration is mandatory if:

Common documents include:

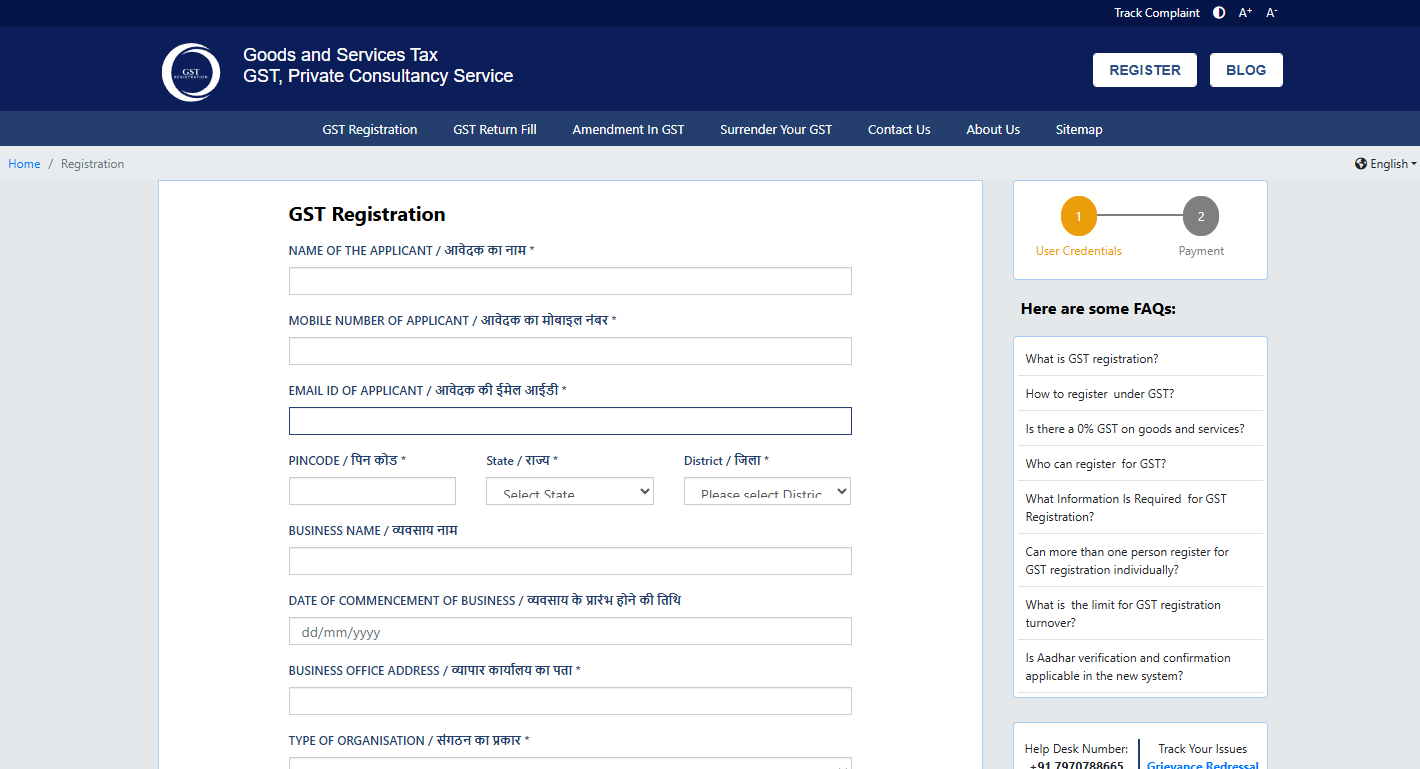

Visit the GST Register portal and select GST Registration

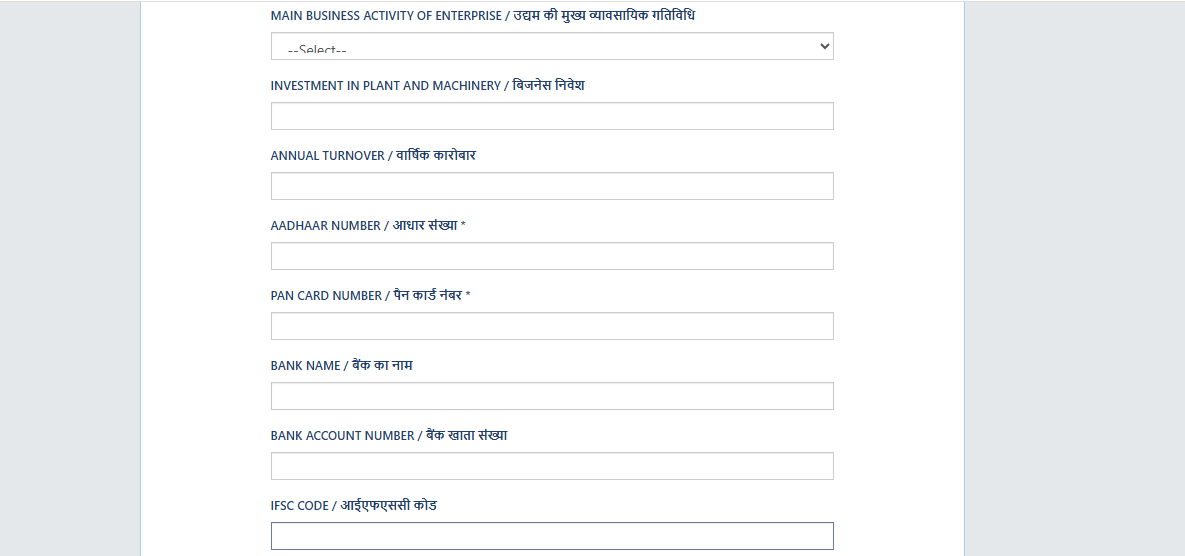

Enter basic details and verify using OTP, fill in business, promoter, Email, your address, etc.

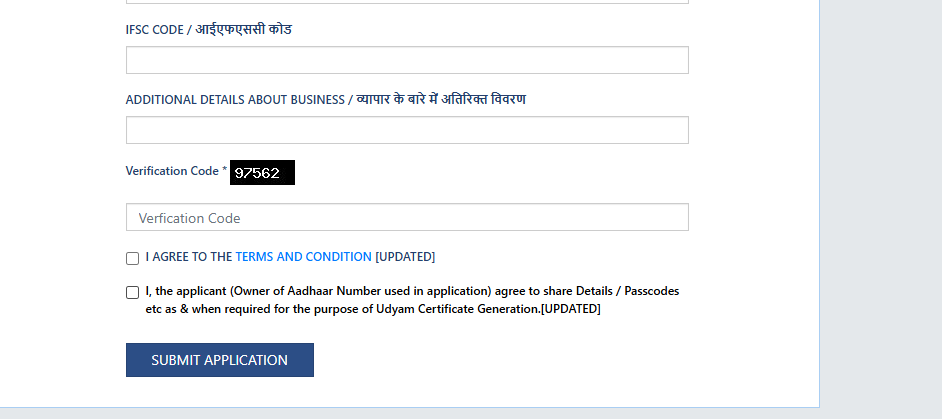

Upload required documents, your bank details,s and Complete Aadhaar authentication and submit the application.

Write the confirmation code after each detail you verify for confirmation. After approval, the GSTIN and registration certificate are issued.

Once registered, a person has to issue GST invoices and file the returns timely, make the payment of the GST, keep the proper records, and follow the GST laws, failing which they may attract penalties or cancellation.

If a business exceeds a prescribed turnover limit, it is required to be registered for GST, or if it is engaged in the supply of goods or services in the course of inter-state trade or commerce,e or in e-commerce. It is designed to let businesses collect tax, take input tax credit, and comply with legal obligations effortlessly while functioning in India under the GST regime.

Meena Kumari specializes in content, articles, and blog writing, delivering accurate, impactful, and relevant information on every topic she covers.